ELSS Mutual Funds: The Smart way to save Tax and build Wealth? Let's find out

Equity Linked Savings Scheme (ELSS) funds represent one of India's most attractive tax-saving investment options, offering the unique combination of wealth creation and tax benefits. If you're looking to reduce your tax burden while building long-term wealth, ELSS deserves serious consideration in your investment portfolio, only when you choose Old Tax Regime.

What are ELSS Mutual Funds?

ELSS funds are equity-oriented mutual funds that invest at least 80% of their corpus in equity and equity-related instruments. What sets them apart from other mutual funds is their eligibility for tax deductions under Section 80C of the Income Tax Act, making them the only mutual fund category that offers direct tax benefits.

These funds combine the growth potential of equity investments with the fiscal advantage of tax savings, creating a powerful tool for wealth accumulation.

Key Features of ELSS Funds

1. Tax Benefits Under Section 80C (Old Tax Regime)

- Deduction Limit: Up to Rs. 1.5 lakh annually

- Tax Savings: Can save up to Rs. 46,800 in taxes (for 30% tax bracket)

- Immediate Benefit: Tax deduction available in the year of investment

2. Shortest Lock-in Period

ELSS funds have a mandatory 3-year lock-in period from the date of each investment—the shortest among all Section 80C investment options :

| Investment Option | Lock-in Period |

|---|---|

| ELSS Funds | 3 years |

| Tax-saving FD | 5 years |

| NSC | 5 years |

| PPF | 15 years |

| NPS | Till retirement |

5 years |

3. How Lock-in works?

For Lump Sum Investments:

If you invest Rs. 1,00,000 on January 1, 2025, you can redeem it only after January 1, 2028.

For SIP Investments:

Each SIP installment has its own 3-year lock-in period:

- January 2025 SIP → Available January 2028

- February 2025 SIP → Available February 2028

- And so on...

4. High Return Potential

ELSS funds have historically delivered 12-18% annualized returns over long-term periods, significantly outpacing traditional tax-saving options.

ELSS vs Other Tax-Saving Options:

| Parameter | ELSS | PPF | Tax-saving FD | ULIP | NPS |

|---|---|---|---|---|---|

| Expected Returns | 12-18% | 7-8% | 4-6% | 10-16% | 8-10% |

| Lock-in Period | 3 years | 15 years | 5 years | 5 years | Till retirement |

| Tax on Maturity | 12.5% on gains > Rs. 1.25L | Tax-free | Fully taxable | Tax-free | Partially taxable |

| Risk Level | High | Low | Low | High | Medium |

| Liquidity | After 3 years | Limited | After 5 years | After 5 years | Very limited |

ELSS vs ULIP :

while ELSS is a pure equity mutual fund with tax-saving benefits on investment alone, ULIPs offer a combination of insurance, investment, & tax-saving benefits on both investments and Returns. The choice between ULIP and ELSS depends on your investment goals, risk appetite, and financial objectives. If you carefully analyse the charges & returns in a ULIP and choose among the top ULIPs in the market, it gives better post tax returns compared to mutual funds (ELSS).

Read more here.

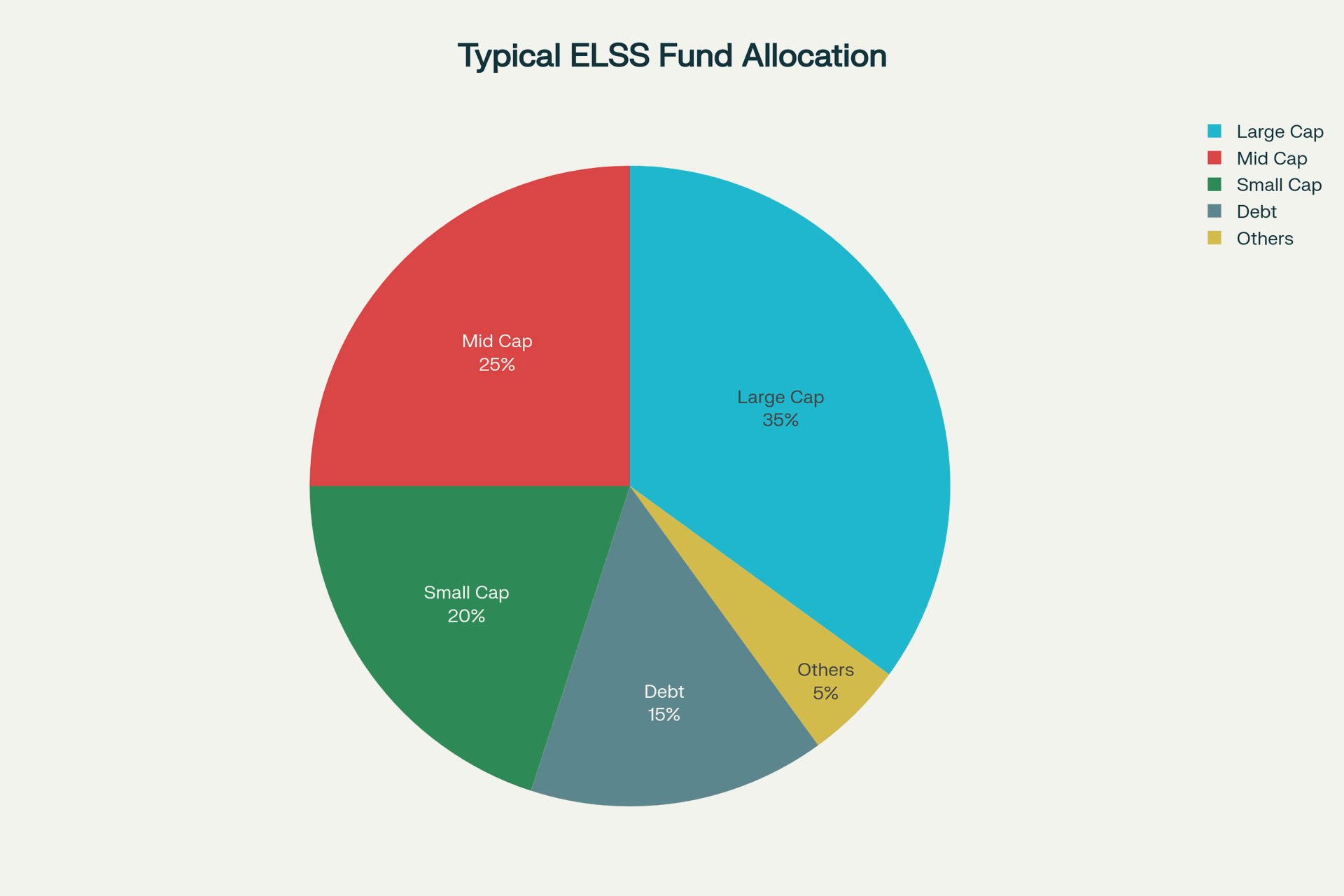

Typical Allocation of ELSS Funds:

Tax Treatment of ELSS

Investment Phase

- Tax Deduction: Up to Rs. 1.5 lakh under Section 80C

- No TDS: No tax deducted at source on investments

Redemption Phase (Post Budget 2024)

- Long-term Capital Gains: 12.5% tax on gains exceeding Rs. 1.25 lakh per financial year

- Tax-free Limit: First Rs. 1.25 lakh of gains completely tax-free

Example: If your ELSS investment of Rs. 1.5 lakh grows to Rs. 3 lakh after 3 years:

- Total Gain: Rs. 1.5 lakh

- Tax-free Portion: Rs. 1.25 lakh

- Taxable Portion: Rs. 25,000

- Tax Payable: Rs. 3,125 (12.5% of ₹25,000)

Who should Invest in ELSS?

Ideal Candidates:

- Taxpayers in higher tax brackets seeking Section 80C deductions

- Long-term investors with minimum 3-year investment horizon

- Risk-tolerant individuals comfortable with equity market volatility

- Young professionals starting their wealth creation journey

Not Suitable For:

- Risk-averse investors preferring guaranteed returns

- Short-term investors needing liquidity within 3 years

- Retirees seeking stable income streams

Maximizing ELSS Benefits

1. Tax-Loss Harvesting

After the lock-in period, you can book profits up to Rs. 1.25 lakh tax-free annually and reinvest to claim fresh 80C deductions.

2. Regular Review

Monitor fund performance annually and switch if necessary (after lock-in).

Summary:

ELSS funds offer a compelling proposition for Indian investors: the shortest lock-in period among tax-saving options under 80C in Old Tax Regime, potential for inflation-beating returns, and immediate tax benefits. While they come with market risks, their track record of wealth creation over 5+ year periods makes them an excellent choice for long-term financial planning.

Top Tax-Savings Investment Plans(ULIPs) in India

- Max Life Online Savings plan

- HDFC Life Click 2 Wealth

- Canara HSBC Promise 4 Wealth

- ICICI Prudential SIP Plus

- Aditya Birla Capital - Wealth Smart Plus

For an honest & spam-free Mutual Fund or ULIP Advice

or feel free to reach out at hello@honvest.com

Our Certified Advisors can help you with best options available

Regards,

Honvest Team.

Equity Linked Saving Scheme (ELSS)