Save upto Rs. 15,625 of Capital Gains tax every year by Tax Harvesting

What is Tax Loss Harvesting?

Tax loss harvesting is a strategy used by investors to offset capital gains by selling investments that have experienced a loss. In India, tax loss harvesting can be used to reduce the tax liability on capital gains. Here are some key points to consider when implementing tax loss harvesting in India:

- Capital Gains: In India, capital gains are taxed based on the holding period of the investment. Short-term capital gains (STCG) are taxed at 20% and long-term capital gains (LTCG) are taxed at 12.5% post Union Budjet 2024. Since they are separately taxed, Tax loss harvesting can be used to offset both short-term and long-term capital gains.

- Off-set tactic: In India, capital losses can be set off against capital gains in the same financial year. If the capital losses exceed the capital gains, the remaining losses can be carried forward for up to 8 years to be set off against future capital gains.

Example : Let's say, I have realised a profit of Rs. 2 Lacs in the financial year 2024-25 (there could be unrealised profits as well). Means I have to pay 12.5% of Rs.2 Lacs as tax. i.e. Rs. 12,500 (Rs. 1Lac from LTCG is exempted from tax). Suppose, I also have unrealised losses (stocks/MFs in loss) in my portfolio, then tax loss harvesting can save some LTCG. How?

I can sell those Stocks/MFs which are in losses and repurchase them after a day. By doing so I will get those stocks at the same price or with not much deviation (there won't be any change in my portfolio), but my realised losses will go up. If I have realised loss for about Rs.50K then my Net realised profit would be Rs. 2-0.5 Lacs = Rs. 1.5 Lacs. So I have saved 12.5% * 50K = Rs. 6,250 tax. Net Tax I should pay would be Rs.6,250 (not Rs. 12,500)

Same way, If you have realised loss you can offset the loss with selling and repurchasing those Stocks/MFs so that you need not declare those losses and avoid carry forward. Infact you can realise net profits upto R.1 Lac which is exempt from

But if you can declare loss during ITR filling and remember to carry forward to later years and offset the profits you make then you can avoid the above step.

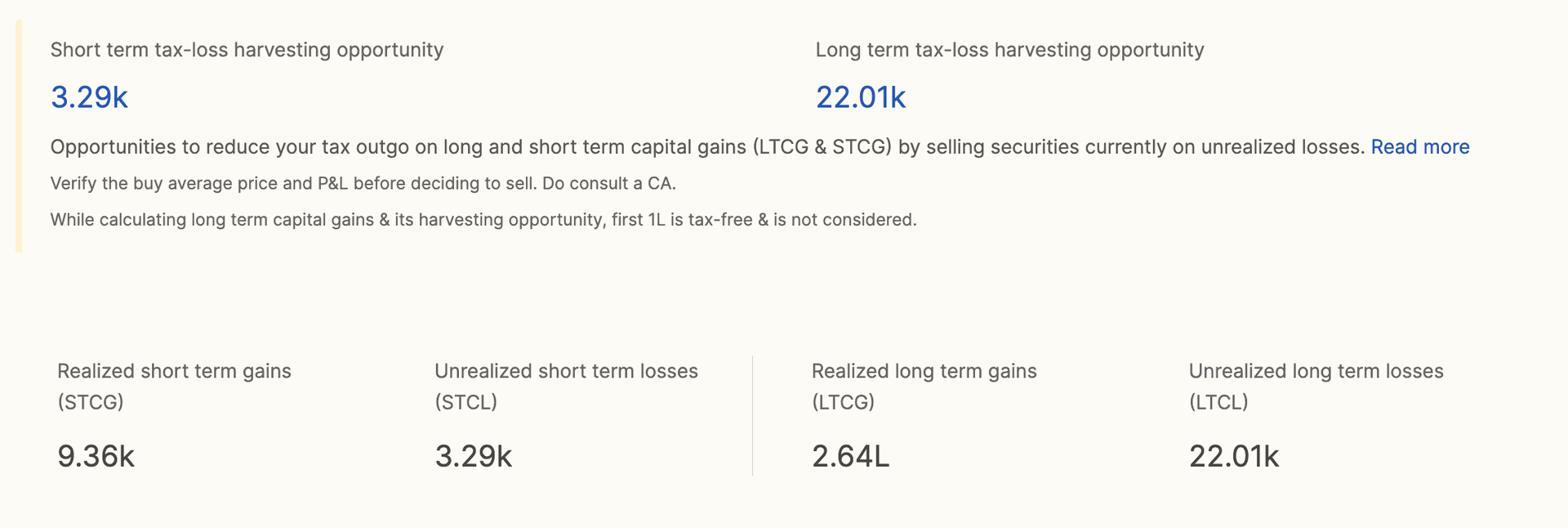

If you are investing from zerodha platform (not a promotion), You can go to >Console > Reports > Tax Loss Harvesting. You may find similar page like the below. I am assuming other broking platforms also do have this feature.

As per the above details, it simply means I have an opportunity of saving tax on for STCG upto Rs. 3,290, on LTCG upto Rs. 22,100. i.e. Rs. (3,290 * 20% + 22100 * 12.%5) = Rs. 3,420 in tax. I suggest you do the harvesting end of Feb or start of Mar.

Summary:

Tax loss harvesting is a strategy used by investors to offset capital gains by selling investments that have experienced a loss. Tax Loss Harvesting is best when you want to rebalance your portfolio (get away with loss making & no future growth stocks). If you realise losses from a stocks and reinvest in the same stock, you end losing those days.

Want to know more about Tax Loss Harvesting?

Please reach out to us at hello@honvest.com

Please do share with your friends and relatives If you think it might help them.

Happy Tax Saving,

Honvest Team.

Tax Harvesting