To know ULIP vs Mutual fund which is better, Lets just have a quick context about ULIP and MF. You may skip to part 3/4.

1.What is ULIP (Unit Linked Investment Plan)?

ULIP stands for Unit Linked Insurance Plan. It is a type of life insurance product that combines life insurance coverage with investment options. With a ULIP, a small portion of the premium paid by the policyholder goes towards providing life insurance coverage, while the remaining amount is invested in various investment funds such as equity, debt, or a combination of both

2.What is a Mutual Fund?

A mutual fund is an investment vehicle that pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. Here are some key features of mutual fund

3. Key Differences : ULIP vs Mutual Fund

| Parameters | ULIP (Unit Linked Insurance Plan) | Mutual Fund (ELSS) |

| Duration | 5 years lock-in period to get tax benefits & to avoid discontinuance charges | No Lock-in, But min 1 year is suggested to avoid exit load & STCG tax |

| Tax Benefits | * Premium paid is qualifies for tax deduction u/s 80C*Maturity amount/ Returns are tax exempt under Section 10(10D) | * Qualified for tax deduction u/s 80C (3 years lock-in) *Returns are taxable at 12.5% |

| Insurance Cover | Available | Not Available |

| Expenses or Expense Ratio | Up to 1.35% (max 1.35% as per IRDAI) | Approximately 0.5% - 1.82% |

Other Charges | Mortality charges, Premium Allocation charges, Policy Admin charges, Commission, Switching charges, Surrender/ Discontinuance Charges, Other charges (specific to policy) | Exit Load |

Though there are tax benefits for ULIP investment returns, There are so many other charges in ULIP which makes it less lucrative and more confusing compared to a mutual fund investment. We have simplified it for you and made it more transparent and handpicked some good ULIPs in the market with No/Less other charges which can give better post tax returns compared Mutual Funds.

Best Investment Plans(ULIPs) for 2025 in India

4. Are there any ULIPs better than MFs?

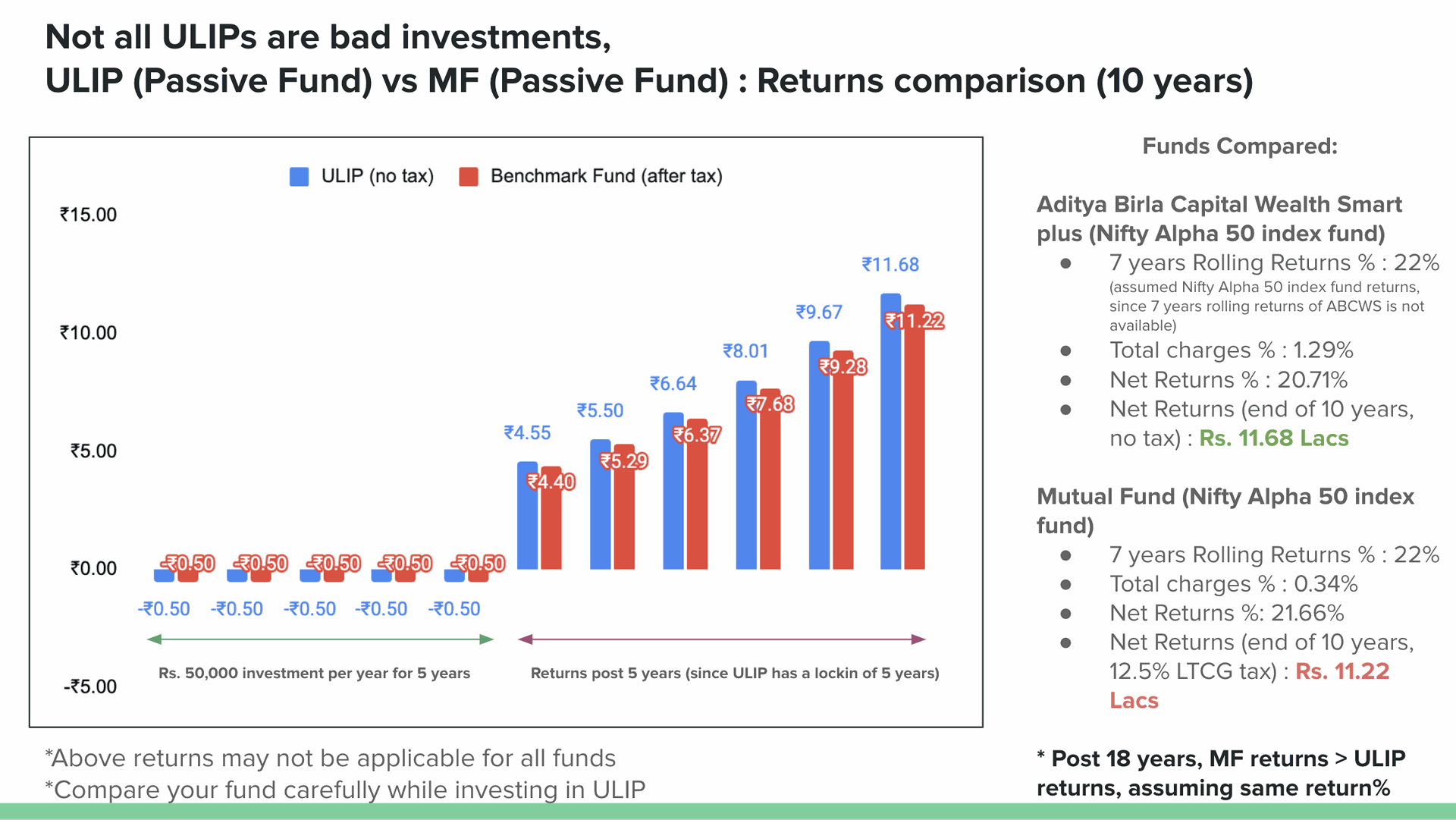

We have compared one of the best ULIPs in the market with MF(that to index fund)

10 years before, If Mr.x invested Rs. 50,000 per year for 5 years in ABCWS Nifty 50 Alpha vs Direct Mutual Fund Nifty 50 Alpha. He would have earned Rs. 46,000 extra compared in ULIP compared to MF.

Please note that ULIP has 5 years Lockin, wherein MF you can ideally withdraw post 1 year (to avoid exit load and STCG).

If you are ok to invest for a long term and want to know more ULIPs giving better returns than Mutual Funds. Please reach out to us.

Want to know more ULIPs which are better than MFs?

or feel free to reach out at hello@honvest.com

Our certified Insurance Advisors can help you with right plan, right coverage, best premium options available

Thanks,

Honvest Team.

Are there any ULIPs better than MFs?