The All-in-One Investment: Why Multi-Asset Funds are your key to a Balanced Portfolio

In a world of volatile markets, investors are constantly searching for the holy grail: an investment that offers growth, stability, and protection all at once. What if you could get the best of equity, debt, and gold in a single, professionally managed product?

Enter the Multi Asset Allocation Fund.

Think of it like a perfectly balanced thali—equity provides the spice of growth, debt offers the staple of stability, and gold adds the flavor of protection against inflation. Together, they create a complete and satisfying investment experience.

What is a Multi Asset Mutual Fund?

A Multi Asset Mutual Fund is a type of mutual fund that invests in a mix of different asset classes. As per SEBI regulations, these funds must invest in at least three different asset classes with a minimum of 10% allocated to each.

The typical mix includes:

- Equity: For long-term capital appreciation.

- Debt: For stability and regular income.

- Gold/Commodities: To hedge against inflation and market uncertainty.

Some funds may also include other assets like real estate (through REITs) or international equities to further enhance diversification.

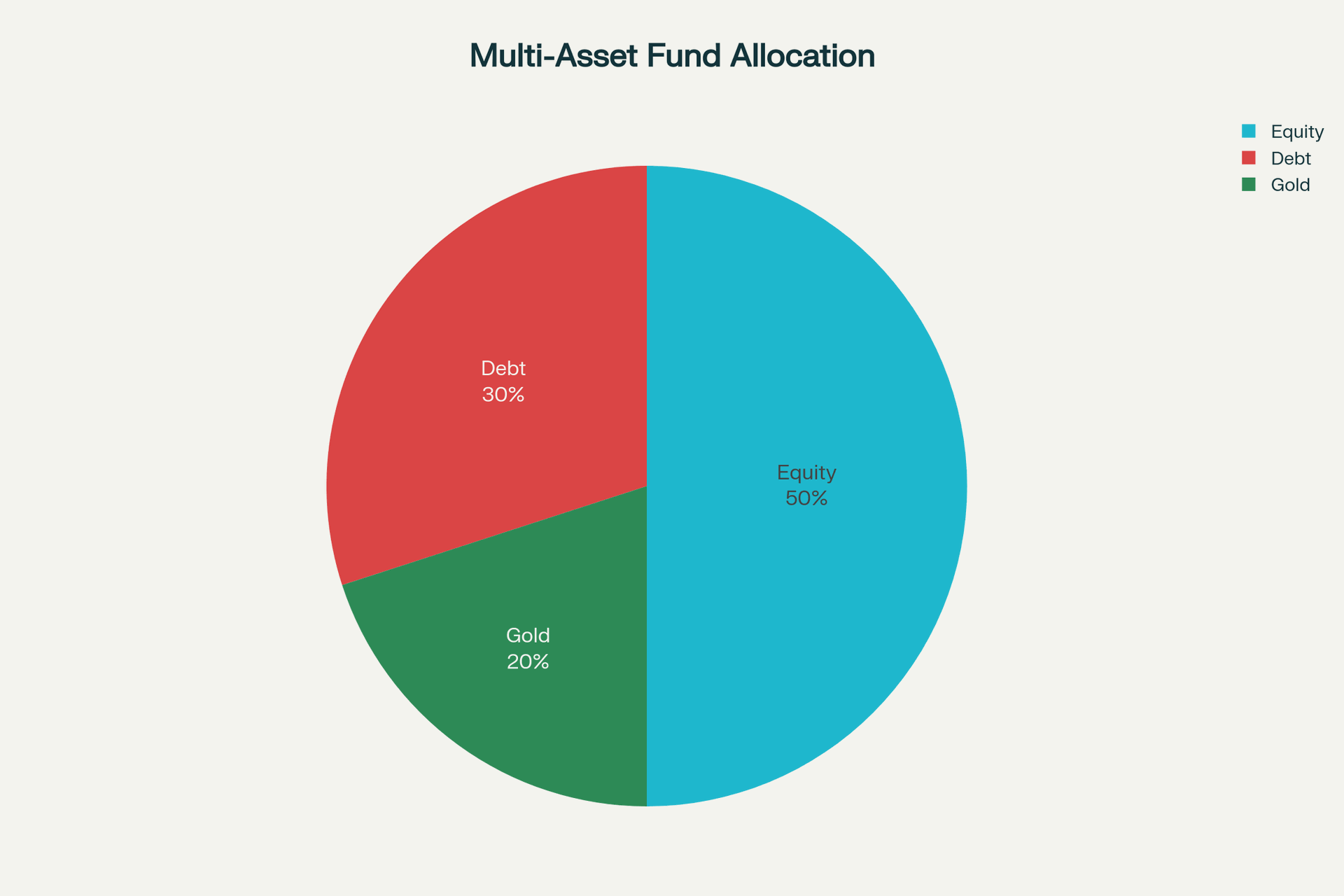

A Typical Multi Asset fund allocation :

Why consider a Multi-Asset Fund in 2025?

In a market environment marked by volatility and shifting economic conditions, a Multi-Asset Fund can be a smart addition to your portfolio. Here’s why:

- Built-in Diversification: These funds automatically spread your investment across different asset classes. When equities are down, debt or gold can help cushion the fall, leading to a smoother investment journey.

- Professional Management & Automatic Rebalancing: You don't have to worry about when to buy or sell different assets. The fund manager actively monitors the portfolio and rebalances it to maintain the target allocation, taking the stress and guesswork out of your hands.

- Tax Efficiency: Many Multi-Asset Funds are structured to be treated as equity funds for tax purposes by maintaining over 65% in equity and arbitrage positions. This means long-term capital gains (after one year) are taxed at a favorable 12.5% (on gains over Rs. 1.25 lakhs), which is more efficient than debt funds where gains are added to your income and taxed at your slab rate.

- Convenience: Instead of buying and tracking multiple funds, you get a diversified, "all-in-one" portfolio in a single product, making it ideal for investors who prefer a hands-off approach.

Who should Invest in Multi-Asset Funds?

These funds are particularly well-suited for:

- Beginners: If you're new to investing and overwhelmed by choice, a Multi-Asset Fund is a great starting point, offering balanced exposure without the complexity.

- Conservative Investors: If you want equity-like growth but are wary of the volatility, the debt and gold components provide a safety net, making for a less bumpy ride.

- Long-term Goal-Based Investors: Whether you're saving for retirement or a child's education, these funds are designed to provide steady, long-term compounding.

Things to keep in mind

While Multi-Asset Funds offer many advantages, they are not a magic bullet.

- They don't Eliminate Risk: During severe market downturns, all asset classes can fall simultaneously. For instance, during the market correction from October 2024 to April 2025, these funds still fell by an average of 6.7%.

- Moderate Returns in Bull Markets: In a strong bull run, these funds will likely underperform pure equity funds. Their goal is balance, not just maximizing upside.

Summary:

Multi-Asset Funds are an excellent tool for building a resilient, long-term portfolio. They offer a disciplined and convenient way to diversify, manage risk, and achieve steady growth. While they may not always be the top performers in a raging bull market, their ability to provide stability and peace of mind during uncertain times is their true superpower.

For an honest Mutual Fund Advice

or feel free to reach out at hello@honvest.com

Our Certified Advisors can help you with best options available

Disclaimer: Mutual fund investments are subject to market risks.

Regards,

Honvest Team.

Multi Asset Fund