How much extra is life insurance for smokers compared to non-smoker in terms of premium?

A smoker or someone who chews tobacco will pay about 40 - 60% more (minimum of 40%) in premiums for a term insurance plan compared to a non-smoker . Yes, you read that right: smokers or tobacco users typically pay 40 - 60% higher premiums than non-smokers.

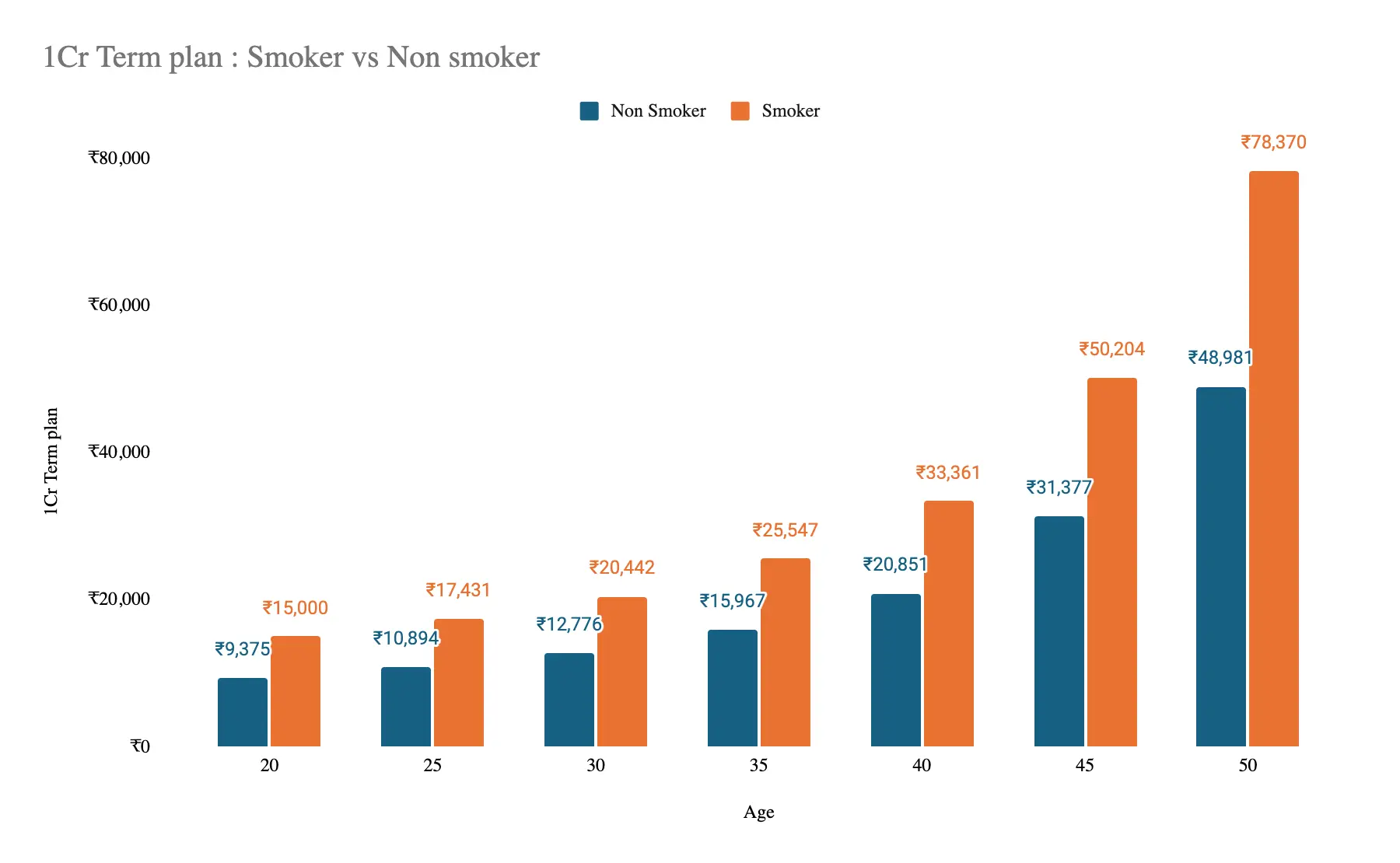

Check Premiums of smoker vs non smoker term insurance:

We’ve included the average term plan premium for a salaried man seeking a Rs. 1 Crore term plan till age 60, at different ages, with a comparison between smoker and non-smoker.

Why are the premiums high for smokers?

Since smokers pose a higher risk to insurers due to the associated health complications of smoking, life insurance companies charge higher premiums to compensate for this added risk.

Should you declare your Smoking habit?

Absolutely. If you smoke or chew tobacco (even occasionally), it's crucial to declare it when applying for a term insurance plan, even though it means paying higher premiums. This disclosure ensures that there are no issues with your claims later on. After all, you're purchasing the insurance to protect your loved ones, and honesty is key to securing that protection.

What if your family doesn't know about your Smoking habit?

This is a tricky situation. Regardless of whether your family knows or not, you should always declare your smoking habit to the insurer when buying a term plan. It’s best to keep at least one family member informed about your policy, as they may need to manage the plan in case of any eventuality.

What if i start smoking after taking term insurance India?

When purchasing a term insurance plan, if you don’t smoke at that time, you should declare yourself as a non-smoker. In future if you start smoking it is better to keep the insurer informed for any future issues or delays in case of claim.

Bottom Line:

Being honest about your smoking or tobacco use is essential to avoid any issues with claim settlements later on. To ensure to pay less premiums, the earlier you take the term plan, the better, as premiums increase with age.

Book a FREE to find the best Term Plan

or feel free to reach out at hello@honvest.com

Our certified Insurance Advisors can help you with right plan, right coverage, best premium options available

If this information was helpful, please hit the like button, share it with anyone who might benefit, and feel free to comment if you need any clarifications.

Thanks,

Honvest Team.

Term Insurance Premium comparison for Smoker & Non Smoker